Borrow

Case Study

Podcasts

Awards

About

An overview of the latest key property market updates and insights for small and medium-sized property developers.

Key takeaways at a glance:

- House prices increase by 1.3%.

- Housebuilding activity declines at sharpest pace since the summer

- Bank of England keeps interest rates at 4.75%

- Government extends Home Building Fund.

- ‘Buyer and seller sentiment is more positive’.

- 2024 vs. 2025 outlook – the tide is starting to turn

Key takeaway 1: House prices increase by 1.3%

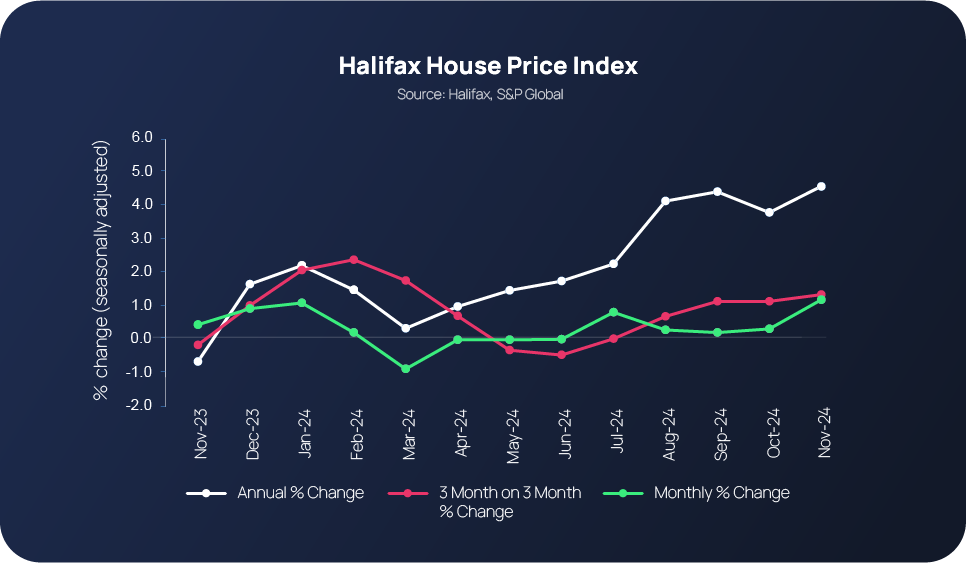

One month after reaching a record high point, UK house prices continued to soar in November; this time by 1.3%. The latest rise is the fifth consecutive monthly increase, which means property prices are now up by 4.8% annually (the highest level since 2022). It also means the average cost of a house in the UK is set to cost homebuyers £298,083 – also a new record.

According to Zoopla, the increase in house prices is widespread. All regions and countries have recorded positive year-on-year growth, with the UK average at +1.5%, up from -1.2% a year ago. In terms of what next year will bring, the property website and app, predicts house prices will rise by 2.5%, culminating with a 5% increase in overall agreed sales.

Halifax’s Head of Mortgages, Amanda Bryden, says the latest figures represent improving demand for mortgages that has been driven by easing mortgage rates and increasing consumer confidence. However, affordability challenges and a changeable economy unfortunately still exist, posing a significant barrier for buyers and movers.

“As we move towards the end of the year and into 2025, positive employment figures and anticipated decreases in interest rates are expected to continue supporting demand. This should underpin further house price growth, albeit at a modest pace as borrowing costs remain above the average of a few years ago,” she says.

On the subject of affordability, it’s been widely reported in recent weeks how UK house prices have increased twice as fast as household income (as revealed by ONS data). This is despite pay growth picking up for the first time in more than a year. As a result, UK properties that cost more than five years’ income have been deemed as ‘unaffordable.’

Key takeaway 2: Housebuilding activity declines at sharpest pace since the summer

The latest S&P Global UK Construction PMI report leads with the fact commercial construction activity in November reported its strongest rise in two-and-a-half years (index at 58.1). This increase has been linked to an upturn in customer demand and new opportunities to tender.

Civil engineering also reported a strong pace in November (55.9), despite the rate of growth dipping to a three-month low.

However, one area that unfortunately failed to report the same positive picture as commercial construction and civil engineering is housebuilding. At 47.9, housebuilding was the weakest-performing construction segment in November after reporting yet another set of negative figures for a second consecutive month. Elevated borrowing costs and fragile consumer confidence have been highlighted as the main contributing factors.

Similar to civil engineering, new business levels increased sector-wide for the tenth month in-a-row in November, but the rate of growth plummeted to its lowest level since June.

Key takeaway 3: Bank of England keeps interest rates at 4.75%

The Bank of England has voted to hold interest rates at 4.75%. At its most recent meeting on December 18, the Monetary Policy Committee (MPC) voted by a majority of 6-3 to maintain the Bank Rate at 4.75%. Interestingly, three of the committee members wanted to reduce the rate to 4.5%, however, it had been anticipated that only one committee member would vote for a reduction.

Continued economic struggles have influenced the latest decision. Last month, the Bank forecast growth of 0.3% in the final three months of the year, which it has since revised to 0%. As for inflation, it has risen for the second month in a row. In November, it was at 2.6%, up from 2.3% in October - the highest level of inflation in eight months, although this was expected by both commentators and the market.

The MPC has said that the increase is ‘slightly higher than previous expectations, owing in large part to stronger inflation in core goods and food.’ Meanwhile, services consumer price inflation has remained high. The MPC expects CPI inflation to continue to slightly rise in the near term.

Savills is predicting that the Bank of England is unlikely to cut the base rate again until February at the earliest, and that the pace of interest rate cuts throughout next year will determine the strength of the housing market in 2025.

Key takeaway 4: Government extends Home Building Fund

The Home Building Fund is set to be extended by the Government, providing up to £700million in additional funding to small and medium-sized housebuilders.

Under original plans, the funding, which is designed to help deliver Labour’s vision of building 1.5 million new homes over the next five years, was due to close in March next year. But last week, the Government announced it would now extend the funding as part of plans to deliver 12,000 additional homes.

Aimed at increasing the amount of cash available to smaller housebuilders and enabling them to help tackle the UK’s housing deficit, the fund will see a range of financial support, including direct loans and lending partnerships, being provided.

Read the full details: https://www.gov.uk/government/news/government-financial-boost-for-small-and-medium-housebuilders

Key takeaway 5: ‘Buyer and seller sentiment is more positive’ – Savills

According to Savills’ November Client Survey, which attracted just under 1,000 responses, buyer sentiment has softened slightly compared to earlier in the year, in the wake of the General Election and in the immediate aftermath of the Budget. A total of 54% of respondents remain unchanged in their commitment to move in the next six months – which could potentially indicate a healthy spring market.

A similar trend was also observed with purchaser budgets, with the overall net balance being below its position from Q1, but still above 2022 and 2023. Meanwhile, the 2% increase in the higher rate of Stamp Duty Land Tax for second homes was the most impactful Budget announcement for respondents.

Read Savills’ Autumn/Winter Prime UK Residential report for the full details: https://pdf.savills.com/documents/Prime-UK-Residential-AutumnWinter-2024.pdf

Key takeaway 6: 2024 vs. 2025 outlook – the tide is starting to turn

This time last year, GDP was flat, inflation was stubbornly sitting at 4% and the Bank of England’s base rate had flatlined at 5.25% following two Monetary Policy Committee ‘hold’ votes after 15 consecutive rate increases. And with a General Election looming, the political landscape looked uncertain from both a UK and geo-political perspective.

The outlook for the UK property market was equally as lacklustre. According to widespread industry speculation, house prices were anticipated to fall by an average of 2.7%, creating added uncertainty for developers in relation to where, and if, they should build next.

Looking back at the Bank of England’s MPC report in November 2023, 12-month GDP growth through to 2024 was expected to be marginally positive. Meanwhile, Q4 2024 inflation was reportedly anticipated to stand at 3.1%, the base rate at 5%+ and unemployment at 4.5%. But looking at all of these measures, the economy is actually in a better position today than originally expected.

Furthermore, the latest property market indices are reporting 12-month growth rates of +4.8% (based on the latest figures published by Halifax in November 2024) and +3.7% (Nationwide, November 2024). These results are a long way away from the late 2023 forecasts that were shared by many credible property market commentators and are paving the way for a brighter and more promising and positive start to 2025.

Mike Bristow, CEO of CrowdProperty, comments:

“The decline in housebuilding activity reflects underlying pressures in actual sense - in terms of developer economics, and perceptively - ie do developers have the confidence in the robustness of end values? Fundamental undersupply will support end values and should give developers the confidence to get building. We enter 2025 with greater confidence and underpinning than the past few years.”

//

Here at CrowdProperty, we work closely and productively with the developers we back – tackling market, site and situational challenges together in partnership.

Our team of property experts actively visit sites to discuss project progress and offer input on any barriers that may need to be overcome.

Learn more about our story and our team

We are a leading specialist property development finance business and have funded £886m worth of property projects to date.

With 300+ years of property expertise in the team, our distinct ‘property finance by property people’ proposition means we understand what developers are looking to achieve and help them succeed.

Apply in just five minutes at www.crowdproperty.com/apply and get an instant Decision in Principle. Within 30 minutes, our property experts will share their insights and initial funding terms, and go on to support the success of your project and help you grow your property business quicker.

Learn about some of the people and projects we have already provided with funding

As featured in...